What is Deriv?

Deriv is a Malta-based online trading platform that offers a variety of financial instruments to trade on its proprietary platforms, including CFDs and derivatives on forex, stocks, indices, cryptocurrencies, options, and commodities.

- Secure and reliable trading environment

- Wide range of derivatives and other market products

- Competitive fees and spreads

- Learning academy with market news, educational videos, and articles

- 24/7 customer support

- Trading conditions and regulations may vary depending on the entity

- Occasional delays in customer support response times

Overall Deriv Ranking

Deriv ranks 8 out of 10 after testing and comparing over 500 brokers. It offers competitive trading conditions and a variety of trading services with competitive fees and spreads.

Comparison to Other Leading Brokers

| Ranking | Broker | Advantages | Spreads | Trading Conditions | Trading Platforms |

|---|---|---|---|---|---|

| 8 | Deriv | Competitive trading conditions, variety of trading services, competitive fees and spreads | Low | Good | Proprietary |

| 7 | ATFX | Low spreads, tight spreads, ECN trading | Very low | Excellent | MetaTrader 4, MetaTrader 5 |

| 6 | Accuindex | Raw spreads, fast execution, no hidden commissions | Very low | Excellent | MetaTrader 4 |

Awards

One of the most notable awards that Deriv has received is the Broker of the Year award at the FinanceFeeds Awards in 2023. The FinanceFeeds Awards are a prestigious awards ceremony that recognizes and rewards the best-performing brands in the online trading space. Deriv was awarded the Broker of the Year award for its success in providing a top-notch trading experience to traders of all levels.

Deriv has also received other awards, including:

- Most Innovative Broker – Global at the 2023 Ultimate Fintech Awards

- Best Customer Support at the 2023 Forex Awards

- Best Trading Platform at the 2023 European CEO Awards

These awards are a testament to Deriv’s commitment to providing its clients with the best possible trading experience.

Is Deriv Safe or Scam?

Deriv is a safe and legitimate online trading broker. It is regulated by multiple financial authorities, including the Malta Financial Services Authority (MFSA), the Labuan Financial Services Authority (LFSA), the British Virgin Islands Financial Services Commission (BVI FSC), and the Vanuatu Financial Services Commission (VFSC). This means that Deriv is subject to strict regulatory oversight and must adhere to high standards of conduct and financial stability.

Deriv Strong Points

- Regulated by multiple financial authorities

- Negative balance protection for traders in certain jurisdictions

- Funds protection through segregated accounts

- Compensation scheme for eligible clients

Deriv Weak Points

- Regulatory standards and protection vary depending on the entity

- Trading services are also available through offshore entities

Overall, Deriv is a safe and reliable online trading broker with a good track record. However, traders should be aware that the level of regulatory protection may vary depending on where they are located.

How Are You Protected at Deriv?

As a regulated broker, Deriv is required to segregate client funds from its own accounts. This means that your money is kept safe and separate from Deriv’s operating expenses. Deriv also offers negative balance protection, which means that you cannot lose more money than you have deposited in your account.

Here are some specific ways that you are protected at Deriv:

- Segregated accounts: Your funds are kept separate from Deriv’s own accounts, so they are safe even if Deriv goes bankrupt.

- Negative balance protection: You cannot lose more money than you have deposited in your account.

- Regulatory oversight: Deriv is regulated by multiple financial authorities, which means that it is subject to strict oversight and must adhere to high standards of conduct.

In addition to these protections, Deriv also offers a number of other features that help to keep traders safe, such as:

- Two-factor authentication: This adds an extra layer of security to your account by requiring you to enter a code from your phone in addition to your password when logging in.

- Secure trading platforms: Deriv’s trading platforms are designed with security in mind and use the latest security technologies.

- Fraud prevention: Deriv has a team of experts who work to detect and prevent fraud.

Deriv leverage

Deriv leverage is offered according to the regulations of different jurisdictions:

- International entities: Traders are eligible to use a maximum leverage of up to 1:1000 for major currency pairs.

- European clients: Traders are allowed to open an account with the Malta entity using leverage up to 1:30.

Leverage is a financial tool that allows traders to control a larger position than their account balance. It can be a powerful tool for amplifying profits, but it can also lead to significant losses if the market moves against the trader.

Deriv account types

Deriv offers three live account types:

- Standard Financial: This account type offers fast and easy account opening, a demo account, and hedging and scalping capabilities.

- Financial STP: This account type offers fast and easy account opening and a demo account.

- Synthetic: This account type offers fast and easy account opening and a demo account.

All three account types have base currencies of EUR, USD, and GBP.

Demo account

Deriv also offers a demo account, which is free to use and allows traders to practice trading without any risk.

Pros and cons

The following table summarizes the pros and cons of each Deriv account type:

| Account type | Pros | Cons |

|---|---|---|

| Standard Financial | Fast account opening, demo account, hedging and scalping | None |

| Financial STP | Fast account opening, demo account | None |

| Synthetic | Fast account opening, demo account | None |

Which account type is right for you?

The best account type for you will depend on your individual trading needs and preferences. If you are a new trader, you may want to start with a demo account to practice trading without any risk. Once you have gained some experience, you can then choose a live account type that best suits your needs.

If you are unsure which account type is right for you, you can contact Deriv customer support for assistance.

Deriv trading instruments

Deriv offers a wide range of trading instruments, including:

- CFDs

- Forex derivatives

- Stocks

- Indices

- Cryptocurrencies

- Commodities

Deriv fees

Deriv offers a cost-effective trading experience with commission-free trading and no deposit or withdrawal fees. However, traders should be aware of overnight fees and an inactivity fee of $25 for accounts that have been inactive for over 12 months.

Based on our testing and comparison to over 500 other brokers, Deriv fees are ranked low, with an overall rating of 8.2 out of 10.

Here is a table that compares Deriv fees to other brokers:

| Fee | Deriv | ATFX | Accuindex |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | Yes | Yes |

| Inactivity fee | Yes | No | No |

| Fee ranking | Low | Low | Low/Average |

Deriv spreads

Deriv offers tight and variable spreads on a wide range of trading instruments, including forex, stocks, indices, cryptocurrencies, and commodities. The average spread on the popular EUR/USD currency pair in forex trading is 0.1 pips, which is much lower than the industry average.

Here is a table that compares Deriv spreads to other brokers for popular trading instruments:

| Asset/Pair | Deriv spread | ATFX spread | Accuindex spread |

|---|---|---|---|

| EUR/USD | 0.1 pips | 1.8 pips | 1.5 pips |

| Crude Oil WTI | 333 | 333 | 333 |

| Gold | 112.6 | 112.6 | 112.6 |

| BTC/USD | 1180 | 1180 | 1180 |

Deposits and Withdrawals

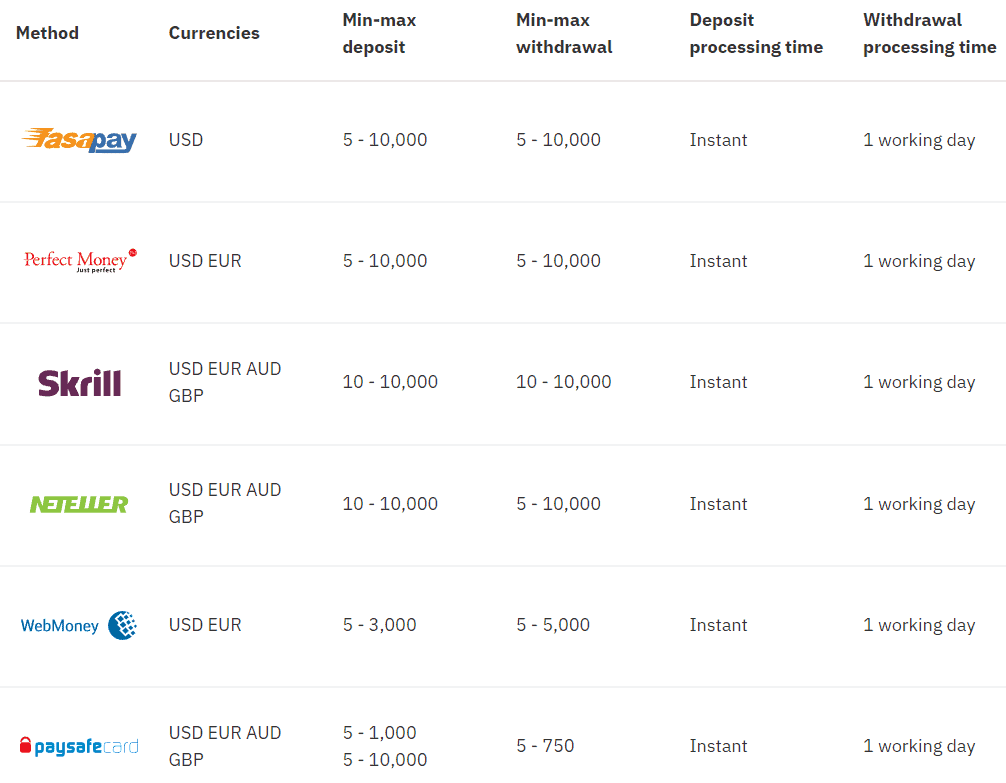

Deriv offers a wide range of deposit and withdrawal options, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. There are no deposit or withdrawal fees, and the minimum deposit amount is $5. However, it is important to note that specific funding methods may have individual requirements and restrictions based on the financial institutions involved.

Overall, Deriv’s deposit and withdrawal methods are very good, with an overall rating of 8.9 out of 10. The fees are low, and there are a variety of account-based currencies to choose from.

Here are some of the advantages and disadvantages of Deriv’s funding methods:

Advantages:

- No deposit or withdrawal fees

- Fast digital deposits

- Multiple account base currencies

- Low minimum deposit amount

Disadvantages:

- Funding methods and fees may vary depending on the entity

- Some funding methods may have individual requirements and restrictions

Deposit Options

- Bank Wire,

- Credit/Debit cards,

- Skrill,

- Neteller, etc.

Deriv minimum deposit

Deriv has a very low minimum deposit requirement of $5, which is much lower than most other brokers. This makes it a good option for traders who are just starting out or who have a limited budget.

Deriv trading platforms

Deriv offers a variety of trading platforms, including its proprietary web platforms Deriv X, Deriv EZ, and Deriv GO, as well as popular third-party platforms like MetaTrader 5 and Binary Bot. All of the platforms offer user-friendly interfaces and a variety of trading tools, such as technical indicators, charting tools, and customizable trading strategies. Most of the platforms can be accessed via web, desktop, and mobile devices.

Deriv’s platforms are known for their reliability and 24/7 technical support.

Here is a table comparing Deriv’s trading platforms to other brokers:

| Platform | Deriv | ATFX | Accuindex |

|---|---|---|---|

| MetaTrader 5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own platform | Yes | Yes | No |

| Mobile apps | Yes | Yes | Yes |

Customer Support

Deriv offers 24/7 customer support through live chat, WhatsApp, and a help center. The broker also has representative offices in several countries around the world, including the UK, France, Cyprus, Guernsey, Malta, Asia, the Middle East, Eastern Europe, Africa, Latin America, the Caribbean, and Oceania.

Overall, Deriv’s customer support is ranked good, with an overall rating of 8 out of 10. However, some traders have reported occasional delays in receiving responses.

Pros:

- Availability of live chat, phone lines, WhatsApp, and help center

- Relevant answers

- 24/7 customer support

Cons:

- Delays in response times

Education

Lastly, Traders can access Deriv Academy which covers recent market news, educational videos, and trading articles. However, the broker does not provide trading seminars, webinars, insights, and other learning materials and research, so if you’re looking for more comprehensive education you may look for other Brokers offering Trading Academy.